Ever since the budget was handed down, Victorians knew the property taxes would go up in their state. With a new report, requested by the state Opposition’s Jess Wilson and released today by the independent Victorian Parliamentary Budget Office (PBO) confirms Victorians will be paying the highest property taxes in the nation.

According to the analysis, each Victorian will pay a total of $2,120 in property taxes per person across 2023-24, compared with $1,646 in New South Wales and $1,343 in Queensland.

Property taxes will make a significant contribution Victoria’s Gross State Product or the GSP as the PBO predicts Victorians will continue to experience an increase in property taxes.

The PBO says “Victoria is expected to rely more heavily on property taxes to generate revenue than any other state.”

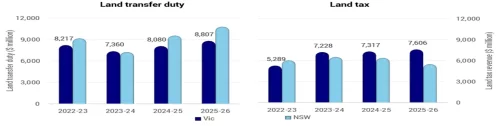

According to the report, Victoria is expected to have the second highest total property tax revenue in 2022—23, after New South Wales, and the highest in 2023—24. From 2024—25, Victoria and New South Wales are forecast to have similar total property tax revenue however the makeup of that revenue is quite different.

Property taxes, Victoria and New South Wales

Note: All data is from 2023–24 state budgets other than NSW which has not yet released a budget for 2023—24.

Source: Parliamentary Budget Office.

Victoria is expected to generate less revenue from:

– land transfer duty (Stamp duty) than New South Wales in each year other than 2023—24

– land tax revenue than New South Wales in 2022—23, but more from 2023—24 to 2025—26,

with New South Wales land tax revenues forecast to decline in 2024—25 and 2025—26.

Property tax revenue per person

Property tax revenue per person gives insight into the relative burden of the taxies each state levies.

Property tax revenue per person

Notes: All taxation data is from 2023–24 state budgets, other than NSW which has not yet released a budget for 2023—24. Per person estimates are derived from ABS data and budget forecasts of population growth.

Victoria is expected to generate the highest revenue per person of any state from the combined property taxes from 2022—23 to 2025—26. Victoria and New South Wales generate substantially more revenue per person than other states for both land transfer duty (stamp duty) and land tax.

Property tax revenue per person, Victoria and New South Wales (NSW)

Notes: All taxation data is from 2023–24 state budgets, other than NSW which has not yet released a budget for 2023—24. Per person estimates are derived from ABS data and budget forecasts of population growth.

Victoria is expected to generate more revenue per person from:

- land transfer duty (stamp duty) than NSW from 2022—23 to 2024—25, but NSW will generate more in 2025—26

- land tax than New South Wales in all years, and by a large margin from 2023—24 to 2025—26.

Property tax revenue as a share of state revenue

Property tax revenue as a share total state revenue gives insight into each state’s relative reliance on these taxes to fund their operations.

Property tax revenue as a share of total state revenue

Note: All data is from 2023–24 state budgets other than NSW which has not yet released a budget for 2023—24.

Victoria’s property tax revenue as a share of total state revenue is expected to be higher than any other state from 2022—23 to 2026—27. Victoria’s reliance on property taxes partly reflects lower revenue from other sources, such as commonwealth grant revenue and royalties — which are not within the scope of this advice. The structure of each state’s economy is a major factor in their different level of reliance on each revenue source.

Victoria and NSW generate substantially more revenue as a share of total state revenue than other states for both land transfer duty and land tax. NSW will beat Victoria on Stamp or Land Transfer duty in 2025-26 but will be lagging way behind on Land Tax in that year. Raising revenue from property, While Victoria generates its top income from property taxes, NSW is a close second state to do that.

Victorian land transfer duty (stamp duty) rates

| Dutiable value | Rate |

| $0 to $25,000 | 1.4% of the dutiable value of the property |

| $25,000 to $130,000 | $350 plus 2.4% of the dutiable value in excess of $25,000 |

| $130,000 to $960,000 | $2,870 plus 6% of the dutiable value in excess of $130,000 |

| $960,000 to $2,000,000 | 5.5% of the dutiable value |

| More than $2,000,000 | $110,000 plus 6.5% of the dutiable value in excess of $2,000,000 |

Victorian land tax – thresholds and rates

| Land value | General rate | Rate for trusts |

| $25,000 to $250,000 | Nil | $82 plus 0.375% of land value above $25,000 |

| $250,000 to $300,000 | Nil | $926 plus 0.575% of land value above $250,000 |

| $300,000 to $600,000 | $375 plus 0.2% of land value above $300,000 | $926 plus 0.575% of land value above $250,000 |

| $600,000 to $1,000,000 | $975 plus 0.5% of land value above $600,000 | $2,938 plus 0.875% of land value above $600,000 |

| $1,000,000 to $1,800,000 | $2,975 plus 0.8% of land value above $1,000,000 | $6,438 plus 1.175% of land value above $1,000,000 |

| $1,800,000 to $3,000,000 | $9,375 plus 1.55% of land value above $1,800,000 | $15,838 plus 1.0114% of land value above $1,800,000 |

| More than $3,000,000 | $27,975 plus 2.55% of land value above $3,000,000 | $27,975 plus 2.55% of land value above $3,000,000 |

“Victorians are being made to pay the highest taxes in the nation because of the waste and mismanagement of the Andrews Government,” the Victorian leader of the Opposition John Pesutto said.

“Every extra dollar in property taxes adds more pressure on rents and property prices at a time Victorians are already struggling to make ends meet.”

“With Victoria’s rents already rising at the fastest rate in the nation, higher property taxes will only make a bad situation worse and push secure, affordable housing for many Victorians even further out of reach.”

“This independent analysis confirms what every Victorian struggling to pay rent or saving to buy a home already knows; Labor’s Rent Tax and higher land taxes are making homes less affordable across the state,” Shadow Minister for Home Ownership and Housing Affordability, Jess Wilson added.

Recent changes to land transfer duty (Stamp duty) and land tax

In the Victorian Budget 2023—24, the government announced changes to both land transfer duty and land tax.

From 1 July 2024, land transfer duty on commercial and industrial properties will be abolished and replaced with an annual property tax. These properties will transition to the new system as they are sold, with the annual property tax to be payable from 10 years after the transaction. The annual property tax for commercial and industrial property will be 1 per cent of the property’s unimproved land value.

From 1 January 2024, the government announced changes to land tax rates with the introduction of the COVID Debt Levy on Landholdings.

The changes to general land tax rates are:

– For taxable landholdings between $50,000 and $100,000 — a $500 flat surcharge will apply

– For taxable landholdings between $100,000 and $300,000 — a $975 flat surcharge will apply

– For taxable landholdings over $300,000:

– a $975 flat surcharge

– an increased rate of land tax by 0.1 percentage points.

The changes to trust surcharge land tax rates are:

– For taxable landholdings between $50,000 and $100,000 — a $500 flat surcharge will apply

– For taxable landholdings between $100,000 and $250,000 — a $975 flat surcharge will apply

– For taxable landholdings over $250,000:

– a $975 flat surcharge

– an increased rate of land tax by 0.1 percentage points.

It is not surprising some Victorians have expressed extreme frustration given the increases applicable to their land holdings. They have been all over the airwaves claiming extreme hardship in maintaining their properties given the size of increase in their tax bills to come.

Please note: The figures/data for the above are from the Parliamentary Budget Office report/advice prepared for the Liberal MP Jess Wilson.

Similar Posts by The Author:

- Australian Muslims call for transparency and accountability of Law Enforcement Action

- India and the United States Spearhead Global Disaster Resilience Efforts through CDRI

- A big win for Nurul Khan in his bid to unmask Victorian ‘Labor dirt sheet plotters’

- Problems of Arvind Kejriwal lie in the Charge-sheet against Manish Sisodia

- ABC Ram Temple coverage: ABC Ombudsman’s “No Bias” report – a slap on the face of Australian Hindus