Consumer groups, financial counsellors and domestic violence advocates have slammed the Australian Government’s plans to remove critical lending protections for women experiencing economic abuse.

Chief Executive Officer of the Financial Rights Legal Centre Karen Cox said our current lending obligations prescribe important steps which often identify red flags in domestic and family abuse.

“These critical protections serve a vital purpose, requiring the lender to make inquiries as to the loan’s purpose, suitability and affordability,” Ms Cox said.

“Australia’s lending laws require lenders to undertake an assessment process that will often put them on notice when loans should not be approved.

“This is an important role in identifying and preventing the financial abuse of vulnerable women.”

After the Global Financial Crisis, the Rudd government introduced lending protections in the form of the National Consumer Credit Protection Act, which was legislated in 2009. The main aim was to shift responsibility from borrowers to lenders as some of the previous lending practices were deemed predatory leading to catastrophic consequences for vulnerable Australian families.

Despite these lending protections in place, the government had to have the Banking Royal Commission which found a lot of pain inflicted on Australians.

And now the government wants to wind back responsible lending rules or lending protections, all in the name of stimulating the COVID-19 affected economy.

The proposed measures will make it easier for Australians to access credit – including home loans, credit cards and business loans because once the lending protections are rolled back, the onus will no longer be on banks to meticulously conduct as before the strictest possible check of a customer’s expenses before lending him the money which he may or may not be in a financial circumstance to meet the regular repayments of.

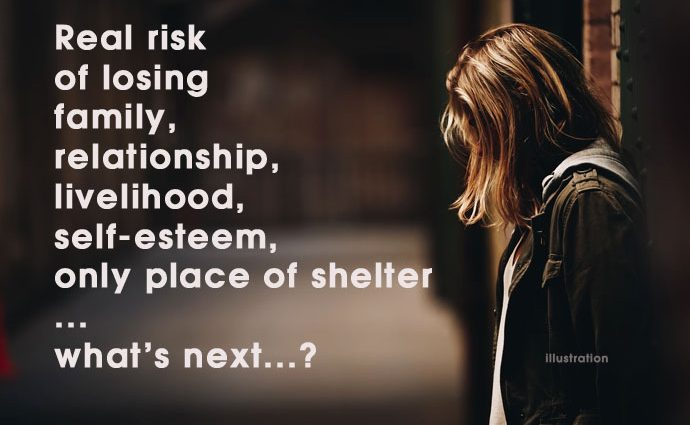

This can be particularly challenging for women who are victims of domestic violence. And if finances go down south in the household, in addition to facing violence and abuse, there will be a real chance of losing their only shelter.

No wonder the advocates of those vulnerable Aussies are crying from the roof tops against the proposed changes.

Tania Farha, Chief Executive Officer of Domestic Violence Victoria said the lending laws we have in place provide a remedy for women when lenders do not undertake the required steps or ignore the red flags of economic abuse.

Carmel Franklin, Chief Executive Officer of Care Financial Counselling said removing these laws will reduce the ability of advocates like financial counsellors and community lawyers to assist survivors with debts that they accrued during abusive relationships.

Laura Bianchi, Team Leader of Redfern Legal Centre’s Financial Abuse Service NSW and coordinator of the Economic Abuse Reference Group NSW, said its members have grave concerns about the impact of removing lending protections on people experiencing domestic and family violence.

“The wind back of responsible lending obligations will have dire consequences for people experiencing financial abuse. Coerced debt is a common factor preventing victim survivors from leaving a violent relationship and re-establish their lives,” Ms Bianchi said.

“It has been well documented that rates of family violence and economic abuse have risen sharply during the COVID-19 pandemic.

“Removing these critical protections at a time when so many women are more vulnerable than ever to economic abuse could have devastating results.”

You can have your say by sending an email to: creditreforms@treasury.gov.au by or before November 20.

The proposed changes will come into effect from March 1, 2021.

Similar Posts by The Author:

- If you are getting out and about, here is the transport alert for 19 April – 25 April

- V/line travellers enjoy the capped fare bonanza

- Pool tragedy: Dharmvir, his father Gurjinder drown trying to save 2YO daughter

- Victorians pay $198.38 million more, thanks to Labor’s IT mismanagement

- Specialist Women’s Health Clinics amid regional health services concerns